Use tip layering to add more blackberry plants to your row or you can tip layer them directly into containters.

Financial Advice For My Kids and Grandkids

Concerning personal finances – information I wish I’d have known when I was young. Use the information below to make living in this world better for yourself, your family and for others in your community. Put into action these few things and if you get them right and start them early then your time on earth can be even better. The short version of the 3 are below and then I will expand more on them along with specific details and other items after.

Part 1 the short version:

To be set up for the best possible time in your life start with the big three to be successful.

- Graduate High School. I’m not saying that you can’t be successful without a high school diploma, but what I am saying is your chances and opportunities are more open with at least a High School diploma. Don’t limit yourself by not graduating. I’ll discuss college later.

- Do not have a child before getting married. More on this in Part 2 that is very important.

Having a child before you are ready puts an unnecessary strain on you, your mate and your child that can cause unforeseen issues. This will also put a strain on your ability to do better financially and there is no reason to rush to have a child on purpose or by accident. Keep yourself under control. Wait until you have got your life and finances in general order. Then you can have children if you so desire as long as it is with the right person that has been chosen well. See Part 2 on the importance of choosing the right spouse. - Money. From the first time you start earning money or as soon as you first learn this: Live off 70 percent of your take home pay (50% is even better) or any monies earned, and you will be financially successful. Most people do not do this. The majority spend all they earn and saving and investing is rare. This was me for a long time until I came across some podcasts and bloggers which I highly recommend you read after this. It will help you immensely in creating wealth for you and your family that can be passed on to your family and donated to charities of your choice. I will put a list of podcasts, books and blogs to read at the end. If you read and listen to these, you will be doing yourself and your family a favor that can make lasting change! Read and listen to them.

That’s it for the short version. If you consistently live off of 70 percent of your take home pay then you will just about guarantee yourself to be financially successful. Living off 70 percent of your income is easy if you start that way. If you come across this knowledge late, do not despair – you can make changes and modifications to get to a 30 percent spending rate. With 30 percent saved each month you will quickly build an emergency fund that amounts to a few months of expenses in reserve and then you will be able to consistently invest each month and create wealth. Soon your money will be making it’s own money. Money is not everything, but it is a useful tool that will make many things more enjoyable and can be helpful in an array of situations and for others. In the end, following this advice will allow you to buy your freedom thru financial independence!

Remember the key for financial success is 8 words:

Make Money, spend less, invest simply, wait longer. I will expand on those 8 words at the end.

Part 2 the details, thoughts and strategies:

Education:

At the minimum, you must graduate high school. As stated earlier, you can be successful without it, but you can also run a race on cement without shoes, but it’s not recommended. One of my favorites sayings is just because you can do something doesn’t always mean you should. Getting at least a high school diploma will open more doors for you. For example, I earned a 4 year bachelor’s degree from University and while I enjoyed my time there, I did not have any classes in information technology even though my eventual career after graduation would be in the technology field. My path into a career within IT was easier because of my college degree. Many of the higher paying jobs in IT require a bachelor’s degree before you can even apply for the job. They didn’t care what your degree was as long as you had a bachelor’s degree and some information technology experience. Without my 4 year degree, the higher paying IT jobs would not have been open to me. I give this example to help you better understand that you need to at least graduate high school to increase your opportunities and have more avenues open to you. Now decades later, more companies and jobs have opened to individuals without a college degree as long as you have some level of experience. A college degree is not required to be successful, but it can be a useful tool if chosen wisely. If you do go to college then be sure to get a more broadly useful degree like business, technology or management. Do some research about degrees and majors before you decide on a path of study. Find the ones that have good job prospects and have a higher starting salary. There are several majors that do not have a lot of job prospects and have lower starting salaries. In today’s job climate – there are trade schools that cost less than college and have better salaries with immediate job openings that you might be better off choosing. You could also start your own business or get in with a business and learn how to do it yourself. Many companies today will hire you into entry level without a degree and you can work your way up and increase your marketable skills as you go. There are also programs where you can get certifiable skills from Google or Microsoft or in demand trade skills like electrical or welding. All can be gained in less than 12 months and can be very profitable without having to go into debt for a 4 year college degree. Look at your options and talk with me or others that are doing the career you want to do. I’m not saying don’t go to college – I’m just urging you to seriously consider all the avenues before taking out loans to go to college and make sure you choose a beneficial path.

Spouse/Family:

Choosing your spouse is a more important decision than most people realize. Just like you shouldn’t buy the first car you see – don’t get intimately involved or marry the first person you think you want forever. Take time to get to know them beyond physical looks or during the good times. People are easy to be around when things are going well. My first advice is to marry someone who loves Jesus more than they love you. If they love Jesus, then they will love you better than someone who does not. No matter who you marry, times will be tough but if you both have common direction thru Jesus then you will have a more stable path. Another saying is that you don’t just marry the person but you marry their family too. Get to know their family as they will be a big influence either positive or negative on your new family. Do not marry someone who cannot control their spending. Money is a top cause of martial distress and if your partner spends too much money it will cause a lot of issues for you and your family. Discuss how money will be handled, spent and just as importantly how it will be saved before getting married. Talking about money can be awkward for many people but it doesn’t have to be. Not talking about this important topic is a recipe for financial instability and potential failure. Money is a tool that can improve your lives so talk about it!

Money:

Financial success can be achieved much easier if you just get a few things right as early as possible. If you don’t start early, you can still be successful, but it may take more sacrifices and that is still worth it. Understand this – money is a tool and you are working to use this tool to ultimately buy your own freedom. Here’s what I mean and how to do this. Once you reach financial independence you have bought your own freedom. I don’t just mean freedom to not have to work. What I’m referring to is the freedom to choose how to spend your time. Time is the most valuable asset you have. You can earn more money, but you can’t get back your time. With Financial Independence (here after referred to as FI) you get to choose if, when and where to work instead of working some place you don’t like or because you have to work. Or feeling stuck working somewhere that maybe you don’t agree with the culture, but they pay you the most. Financial freedom is about being able to spend your time and money the way you feel is best for you. Another way to think about this is you’re not just saving money or depriving yourself – instead, you are working to buy your freedom!

An excellent blog post called the shockingly simple math behind early retirement by Mr. Money Mustache is an eye-opening read. I talked earlier about living off of 70 percent of your take home pay and saving and investing the other 30 percent. The math behind early retirement shows that if your savings rate is a certain amount then you can retire in a corresponding number of years. For example, if you can save 50% of your money each month then you can retire in roughly 17 years.

If you have a full time job at 23 and save 50% then you are on track to purchase your freedom at age of 40 years old! See the below chart from the Mr. Money Mustache blog:

https://www.mrmoneymustache.com/2012/01/13/the-shockingly-simple-math-behind-early-retirement/

| Savings Rate Percent | Working Years Until Retirement | ||

| 5 | 66 | ||

| 10 | 51 | ||

| 15 | 43 | ||

| 20 | 37 | ||

| 25 | 32 | ||

| 30 | 28 | ||

| 35 | 25 | ||

| 40 | 22 | ||

| 45 | 19 | ||

| 50 | 17 | ||

| 55 | 14.5 | ||

| 60 | 12.5 | ||

| 65 | 10.5 | ||

| 70 | 8.5 | ||

| 75 | 7 | ||

| 80 | 5.5 | ||

| 85 | 4 | ||

| 90 | Under 3 | ||

| 95 | Under 2 | ||

| 100 | Zero | ||

Now that you have read all of that – how do you start and what do you do? Check out part 3 below.

Part 3 Getting Started:

Assess where you are currently.

If you don’t know where you are then it is difficult to know where you are going. Look at your expenses and your total take home income from all sources and then create a monthly budget. I know some people dislike the idea of a budget as they think of it as restrictive. Comments you may hear or even be thinking to yourself are “I don’t want a budget” or “I don’t want to be told I can’t spend my money a certain way” among other iterations. However you may feel about a budget, you need to have a mind shift in this area. Make no mistake – your money each month is being spent – it’s just a decision of is it being spent in a way that buys your freedom or just buys stuff…

Stuff usually has little to no future value but your freedom is always valuable.

I was this way at first. I didn’t like the idea of a budget because I wrongly thought I’d be removing the fun out of my life. A budget is liberating once you realize your money is being spent and you can budget it in a way that allows you to do some things you like while working to buy your freedom. If it makes you feel any better or helps you to get your spouse on board, you can also call it a spending plan instead of a budget. Total up your monthly expenses and then total up your monthly income that makes it into your bank account. Subtract your total expenses from your total income and note how much is left over. The leftover is currently how much you have to save and invest and you can also calculate what your savings rate is. To calculate your savings rate use the following equation:

Monthly income minus your monthly expenses divided by your monthly income.

Example:

$8,000 per month after taxes income take home pay.

-$6,400 per month expenses (house payment, insurance, food, medical etc all your expenses)

———-

$1,600 per month left over savings.

$1,600 divided by $8,000 is a savings rate of 20% which would take 37 years until retirement according to the retirement chart. Don’t get discouraged as you can increase your savings rate and or increase your income to reduce the time until retirement/freedom! Also remember that saving 20% or your income is miles ahead of most people who save almost nothing! If you are not currently saving anything that is ok because you can make changes starting today!

Reduce your spending

Now take time and work thru your budget and expenses. The simplest way to increase your savings rate is to cut expenses. Can you make more meals at home? Can you bring leftovers to work a couple of times a week? Do you need all of those streaming services or just one? Can you change your car insurance and get a better deal? We found that planning when we went out to dinner was a quick way to save money. Instead of just going out every night because we were tired or whatever other excuse we came up with, we chose to have dinner out on Tuesday nights and Saturday nights. You could do more or less but make it something that you and your spouse agree on. We found cooking dinner at home was more cost effective and we enjoyed the time making the meals with each other and our family. After examining your expenses and making a few changes you might now be here:

Updated projections

$8,000 per month after taxes income take home pay.

-$5,200 per month expenses (house payment, insurance, food, medical etc all your expenses)

———-

$2,800 per month left over savings.

$2,800 divided by $8,000 is a savings rate of 35% which would now take 25 years until retirement which is 12 years sooner to freedom than before! It’s not unreasonable to continue to drive up your savings rate by looking for more areas to save or by keeping your spending rate the same even as your income increases (raises and promotions). Don’t fall into lifestyle creep and don’t try to keep up with neighbors. When you get a raise or promotion don’t just spend more because you have more. Instead, save and invest more! Your ability to delay gratification will benefit you in all areas of your life, not just financially.

Build an emergency fund

Research shows that the average family doesn’t have enough saved up for a surprise $500 bill. That can cause a lot of stress when inevitably something pops up. I felt for our family it was best to build an emergency fund. I wanted to have that peace of mind that if something happened, we’d have an answer financially. We eventually built up a 1 month salary emergency fund. We kept building and working up to a 3 month and finally a 6 month salary emergency fund. You don’t have to go as far as we did but that is what I chose for us. Start with building up a $500 dollar fund and work up to a month’s salary. From there you can re-assess and decide if you want to make it larger or start investing.

Taxable Brokerage Account:

Now that you have an emergency fund saved, go to Fidelity.com or Vanguard and open a taxable brokerage account. Here you can start investing to build personal/family wealth. I took some of our savings we had and put them to work in low-cost index funds called FSKAX at Fidelity. Each month we take our savings and add some to our high yield savings account (currently earning 4.3% APR), some towards our ROTH IRAs and some into our brokerage account in the form of FSKAX low-cost index funds. All three of those are compounding and working for us. Now we wait longer and let the magic of compounding work for us! Talk to me about this if you have questions and I’ll help walk you thru it.

Retirement accounts

401K:

If you have an employer that does a matching 401K or other savings/retirement program, make sure you contribute at least up to the match they are giving. Otherwise, you’re missing out on free money from them. One of the companies that I worked for when I was in my mid 20s did a 3 percent 401K match. If I contributed 3 percent of my salary to the 401k then they would match another 3 percent free. I’m very thankful to a co-worker named Sean M that pointed this out to me. Had he not told me about this and strongly encouraged me to do it then I would not have one of my largest 401Ks that I have now. I only contributed to this 401k for about 4 years. For the next 20 years, it compounded and grew without any further contributions from me. Thanks Sean! Note – I wish I would have continued to add to this 401K after leaving that company, but I didn’t know I could roll it over. I recommend you put your 401K into low-cost total stock market index funds like FSKAX or VTSAX if that is an option with your employer 401k. If not, something similar with the lowest fees possible.

Roth IRA:

I also have a ROTH IRA. This is a retirement account that has two main benefits.

1. It grows tax free and when you reach 59.5 years of age – you can withdraw tax free.

2. The money you contribute is after tax money and that means, if necessary, you can withdraw your contributions at any time without paying a tax or penalty. Some people now start their emergency fund as their ROTH IRA. For example, you start your ROTH and contribute to it every month knowing that if an emergency comes up, you can access your original contributions tax and penalty free. All the while, your Roth IRA is growing and compounding! I recommend you put your Roth into low-cost total stock market index funds like FSKAX or VTSAX or an S&P 500 index fund.

A few other topics that need to be discussed.

Debt

Credit Cards:

Do not let yourself get trapped by credit card debt. Many people get stuck behind their debt with no real plan to efficiently resolve it. If you are not able to pay your credit card in full each month then don’t use one. If your credit card is charging 18% interest, then you might be paying it off over a very long period of time and that is not helpful for achieving financial independence. A good rule to follow is before you charge something ask yourself:

1. Do I really need this or just want it?

2. If you think you need it then ask yourself

A. Can I borrow it free from a friend, neighbor or family member?

B. Can I get it used online or from a garage sale or craigslist.com?

C. Can I wait a bit longer, even just one more day before purchasing? This gives you time to find it cheaper or free and sometimes you end up not even buying it in case of impulse purchases.

If you are able to consistently pay your credit card bill in full each month then you can use certain credit cards to your advantage. This is ONLY if you can pay in full each month. There are travel rewards and also cash back rewards. We found that Fidelity has a good reward program of 2% cash back that is automatically deposited into our brokerage account. We charge most of our monthly items (groceries, dining out, gas, miscellaneous purchases, gym membership, medical visits etc.) and pay it in full each month never carrying a balance and avoiding any credit card interest. Because of that, we have earned over $1,000 each year in cash back that is automatically added to our brokerage account and is then earning additional interest and growth. Ask me about this if you have additional questions.

Start building wealth

A man I worked with for many years and whom I respected gave me a book called “The simply path to wealth” by JL Collins. That book was very helpful in my journey to FI and investing. It is not the only way but it is a simple way and has worked well for me. If you stay living below your means and by that I’m saying you consistently spend less than you earn, then you can consistently build your wealth each month. Reminder – if you simply spend less than you earn each month then you are doing better than the majority. We live in a me first and if it makes you happy then do it society. One where most people cannot delay self-gratification. My parents did not teach me much about spending and saving or I probably didn’t listen. I’m certain as a young teenager they briefly mentioned to me that I should save some of my money when I got my first job but that’s about it. My family did not talk about money and certainly about personal finance and investing. When I started earning money as a teenager and beyond, I spent it all. My friends were the same. If you earned it then you spent it. That continued into my 20s and 30s. At that time, I kept a little saved but nothing meaningful. I fell into the bad habit of spending all I had, and lifestyle creep took all that we gained in terms of promotions and raises. Once you have your emergency fund created which can be as little as a few hundred dollars you need to start building wealth. This can be done simply in a variety of ways.

High yield savings account

Our emergency fund is in a high yield savings account so it is earning money for us every month which is an additional income stream. The interest we earn each month is reinvested back into the high yield savings and growing with compound interest. The money is easily accessible in case of an emergency but also working for us while we sleep.

Remember the key for financial success is only 8 words:

Make money, spend less, invest simply, wait longer.

Make Money – get and keep a job so you have a steady income.

Spend Less – whatever amount you earn you simply spend less and you’ll have a surplus. I cannot overstate the importance of spending less than you earn. Many people are plagued by spending.

Invest Simply – choose simple investments with low fees. Broad-based index funds are an excellent choice. They pay dividends which you will want to auto reinvest and they increase over time.

Wait Longer – The sooner you start investing and the longer you wait the more time your money has to compound and grow. Also – wait longer before buying things. You may end up not even wanting them anymore, which saves you from impulse buys.

Recommended readings:

Podcasts, blogs and books:

While you’re working on your fitness and health (running, walking, exercising) listen to financial podcasts. They can be interesting, entertaining and very helpful for learning about financial matters or other beneficial topics.

Listening to them while in your car is another option to maximize your time and learning.

Podcasts:

Choose FI (episode 19 and 284) plus most of the other episodes.

Catching up to FI

Peter Attia – The Drive podcast. This is more of a health podcast but worth looking at the various episodes and listening to the ones that interest you.

Blogs:

JL Collins

https://jlcollinsnh.com/2011/06/08/how-i-failed-my-daughter-and-a-simple-path-to-wealth/

Mr. Money Moustache

https://www.mrmoneymustache.com/2012/01/13/the-shockingly-simple-math-behind-early-retirement/

Books:

The Simple Path to Wealth by JL Collins

Postpone Lifestyle Inflation

Key note: As you earn more, do everything you can not to spend more.

Keep inflating your savings rate and not your lifestyle.

Common for many people, myself included, is lifestyle inflation where you spend more as you earn more. That was me for my early adult life and I’m embarrassed to say continued until about 5 years ago. Everyone I knew followed the tune of you earned it so you can spend it. And while that is true, it is not the best attitude to have if you are purposely looking at your future which many people are not.

I don’t remember if I heard this from ChooseFI, JLCollins or another personal finance site but it was generally this:

For those that don’t want to save and think they need to spend all they earn – consider this:

I AM spending all I earn – I’m just not spending it on the same things you are. I’m spending all I earn on purchasing my freedom! You’re buying things that will break or soon be discarded or give short term escape from time at hand. What I’m buying are things that increase in value over time compounding consistently until I can make the best purchase for me which is freedom! Freedom to work where I want to and when I want to if at all. Volunteer or help others – the choice will be mine!

The technique I used to postpone lifestyle inflation and it worked well was to keep our income the same in our budget software even as we both got raises and promotions. We used YNAB for our budgeting or spending plan depending on how you want to look at it. For several years, I kept our monthly income listed in the budget the same as it had been. For example, say we had a combined income of $10,000 per month and then one of us got a promotion and the other got a raise. Now our income would be $11,000 per month but I left it as $10,000 in the budget. This made it much easier to continue budgeting with the same mindset of $10,000 monthly income. This helped to prevent the common change of how to divide up the extra $1,000 each month. I know many will say just add that extra $1,000 each month to your savings and that was what happened behind the scenes but it was not there on the front end to see. There’s something about not seeing that money in the budget that made it easier not to spend it. Easier not think oh well we have that extra $1K this month so it’s ok if we go overboard a little on this or that. Staying with that continuous $10K budget works wonders.

Our budget includes a monthly savings rate of around 20-30 percent. Now that extra $1K just goes straight to our savings and investments and our actual savings rate inflates instead of our lifestyle! Give it a try!

Error 0x00002EE2 Hyper-V Enabling Replication Failed

Error 0x00002EE2 while enabling Hyper-V replication to another Hyper-V server. This can be caused by the firewall and fixed by setting Hyper-V Replica HTTP Listener (TCP-In) rule to enabled.

To fix go to the replica receiving Hyper-V server:

Windows Defender Firewall with Advanced Security – Inbound Rules

Hyper-V Replica HTTP Listener (TCP-In) – enable the rule.

MDT Client Boots to Command Prompt

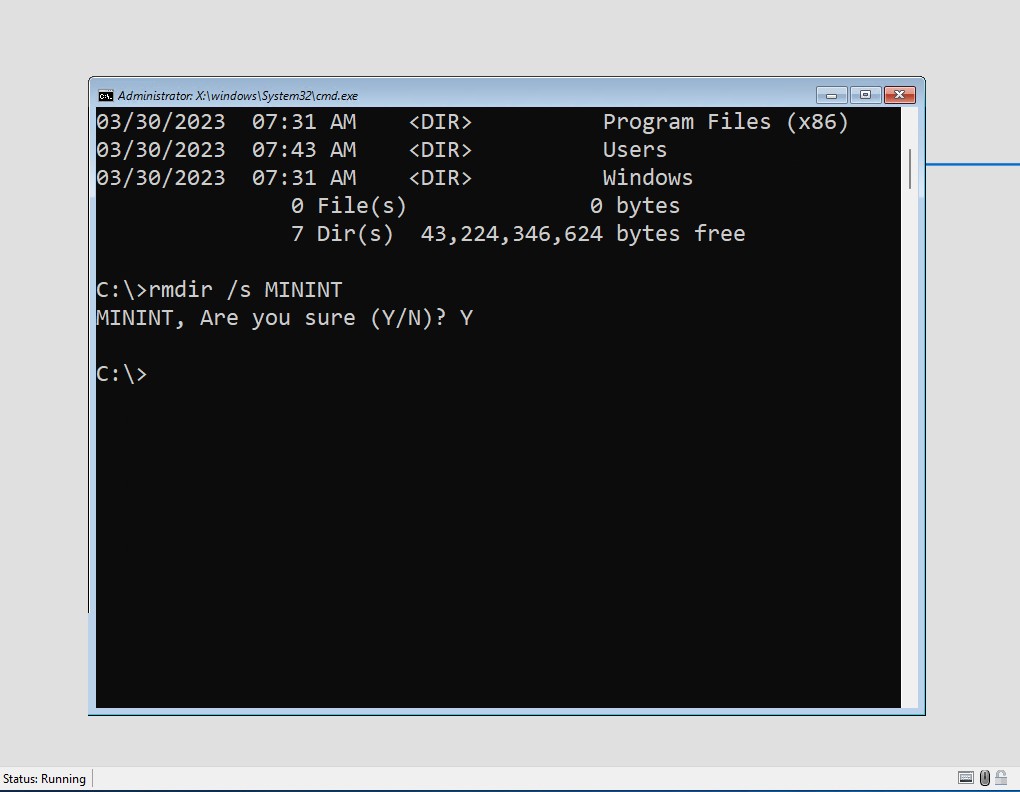

I have a laptop that I was imaging with MDT and it starts the MDT process but goes to a command prompt and does not go forward with the MDT screen. Here is what fixed this issue for me.

Booting to MDT on the client.

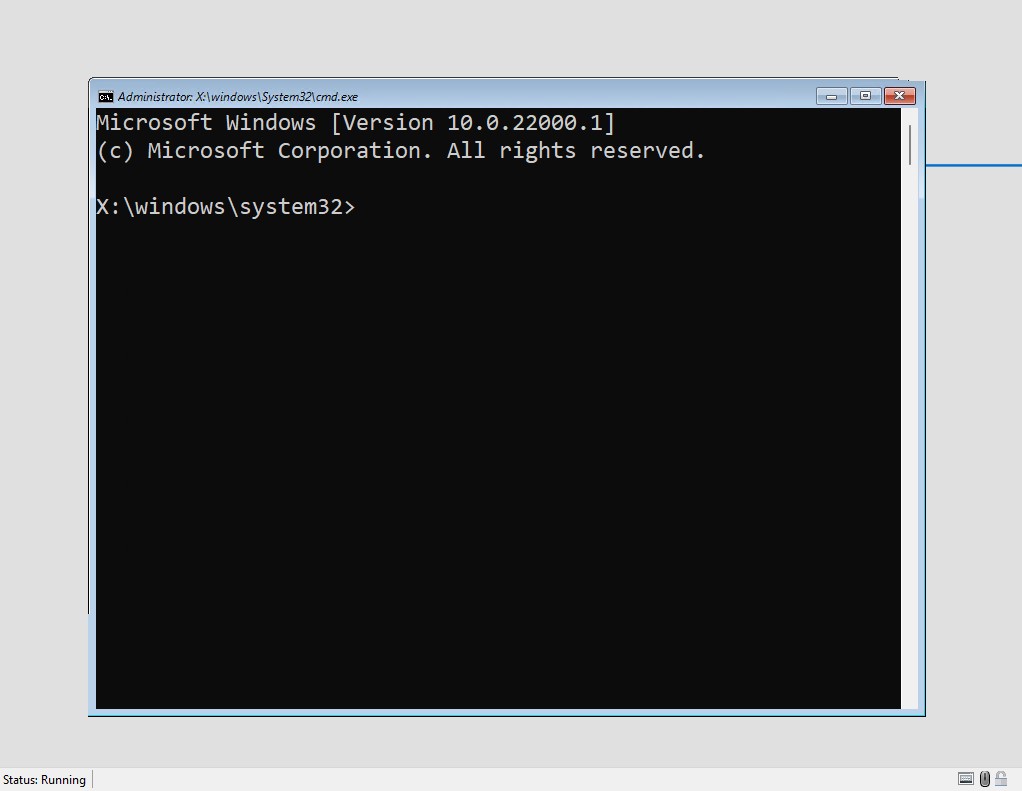

Returns to a command prompt not starting the MDT process.

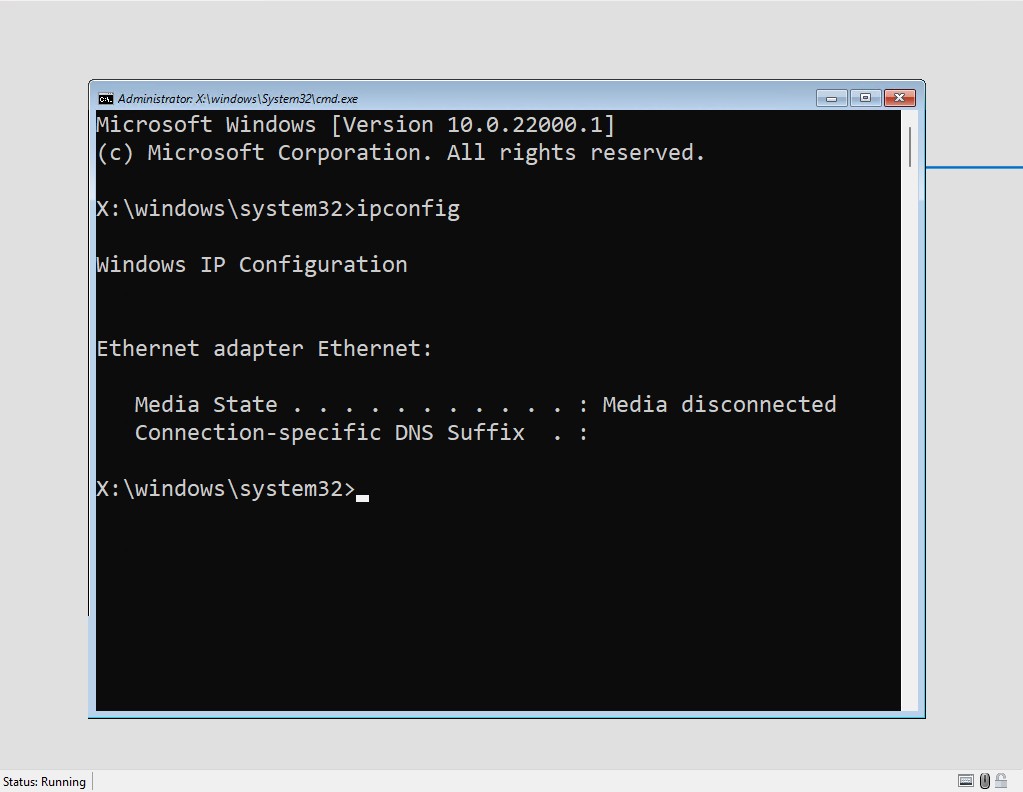

I run ipconfig and the network driver is not loaded.

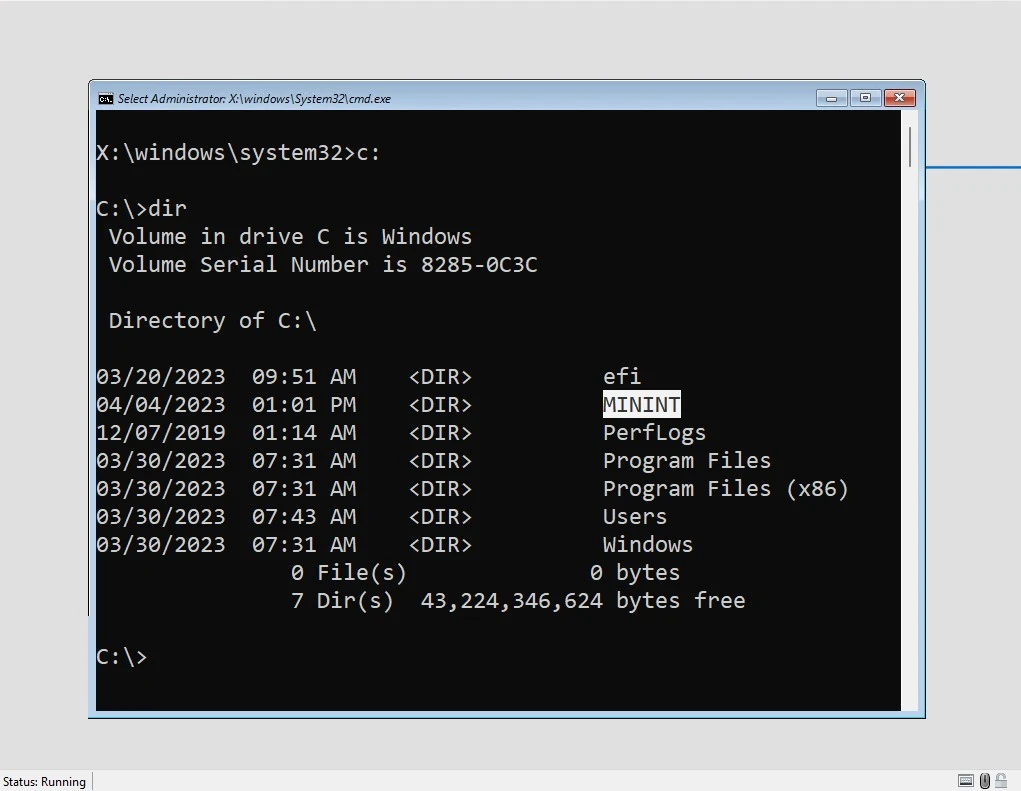

Change to C:\ and run the “dir” command to check for the MININT directory.

Run command “rmdir /s MININT” to remove directory including subfolders.

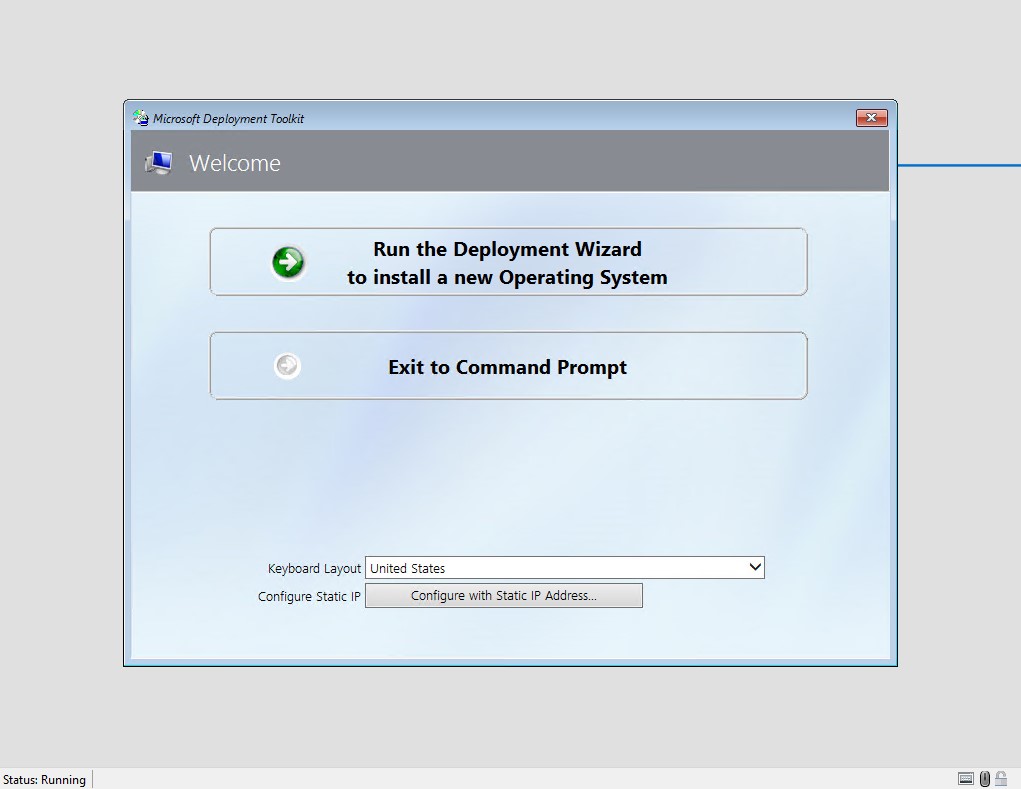

Now the next time I restart and try to image with MDT I get the deploy screen.

- Boot the MDT on the client.

- At command prompt – change to C:\ and then run the “dir” command to check for the MININT directory.

- Run command “rmdir /s MININT” to remove directory including subfolders.

- Retry booting with litetouch or pxe and run the deployment wizard.

Grow Muscadines Grapes at Home

How to grow muscadines grapes at home starting with a bare root plant and harvesting the fruit 1 year later.

End of Season Steps for Blackberry Plants

5 steps to take at the end of the blackberry growing season.

Germinate Seeds Faster By Peeling Seed Coating

How to germinate seeds fast.

I’ve found that simply peeling the seed coating makes the seeds germinate faster. I’ve done this will several seeds including avocado, lemon, apple, and peaches. I use the paper towel method to start them and the ones that have been peeled start the process faster than those that have not. This saves me time when planting seeds as I’ll know which ones are ready several days sooner. See the video above.

Trench Method Direct Composting

If you are interested in composting, then try the direct method in your garden. After my strawberries have finished producing for the season, I will start the trench method for composting. This involves storing up kitchen scraps like fruit and vegetable parts and keeping them in a plastic bag in the freezer. At the end of the week, I’ll take what I have to the garden to be composted. I’ll dig a trench down the row where my strawberry plants were and then place them all inside the trench. Add some grass clippings and move the soil back over the top.

This will give the materials at least 6 months to break down before I re-plant strawberries next season in the spring. Check out my video above to see the process and how I built composting bins using free pallets.

Root Cuttings from Blackberry Plants

I picked up a tip layered blackberry plant and found it had roots growing from the bottom on the container. I decided to cut the roots so I could move the tip layered blackberry plant and then I dug up the largest root and made 3 cuttings.

You can watch the whole process in the video above.